Get interesting information about Business Credit Cards That Don’T Report To Personal, this article is specially curated for you from various reliable sources.

Business Credit Cards That Don’t Report to Personal: An In-Depth Guide

In the world of business, maintaining a strong credit profile is essential. However, using personal credit for business expenses can damage one’s personal credit score and make it harder to qualify for personal loans in the future. Fortunately, business credit cards that don’t report to personal credit bureaus offer a solution to this problem.

These specialized credit cards allow businesses to build a business credit history separate from their personal credit. By using a business credit card for business-related purchases, business owners can improve their business credit score and access financing opportunities that would otherwise be unavailable to them.

Subtitle: Understanding Business Credit Cards That Don’t Report to Personal

Definition

Business credit cards that don’t report to personal credit bureaus are credit cards specifically designed for business use that do not report transaction history or payment information to personal credit reporting agencies like Equifax, Experian, and TransUnion. This means that the use of these cards does not impact the cardholder’s personal credit score.

History

The first business credit cards that didn’t report to personal credit bureaus were introduced in the 1990s. These cards were initially marketed to small businesses and entrepreneurs who needed to build business credit without affecting their personal credit.

Meaning

The primary benefit of using a business credit card that doesn’t report to personal is that it allows business owners to separate their business finances from their personal finances. This can protect their personal credit score from business-related debt and expenses.

Benefits of Business Credit Cards That Don’t Report to Personal

Apart from protecting personal credit, business credit cards that don’t report to personal offer several other advantages:

- Easier loan approval: With a strong business credit history, businesses can qualify for loans and lines of credit that are typically unavailable to individuals with limited personal credit history.

- Lower interest rates: Businesses with good business credit scores can often secure lower interest rates on loans and financing options.

- Improved vendor relationships: Vendors may be more willing to extend credit and offer discounts to businesses with strong business credit.

- Increased purchasing power: Business credit cards can provide businesses with additional purchasing power, allowing them to make larger purchases or invest in equipment and inventory.

How to Qualify for a Business Credit Card That Doesn’t Report to Personal

Qualifying for a business credit card that doesn’t report to personal credit bureaus typically requires the following:

- Proof of business ownership: This can include documentation such as a business license, articles of incorporation, or a tax ID number.

- Strong business credit score: Lenders will typically review the business’s credit history to assess its risk.

- Sufficient income: Businesses will need to demonstrate that they have sufficient income to cover the expenses charged to the card.

- Low debt-to-income ratio: Lenders want to ensure that the business has the capacity to repay its debts.

Expert Advice on Using Business Credit Cards That Don’t Report to Personal

Here are some expert tips to consider when using business credit cards that don’t report to personal credit bureaus:

- Use the card responsibly: Treat the card as a business expense and avoid using it for personal purchases.

- Make timely payments: Paying off the balance on time helps build a strong business credit history.

- Monitor the card’s activity: Regularly review the card’s statement for unauthorized transactions or errors.

- Beware of fees: Some business credit cards that don’t report to personal may have higher fees than personal credit cards.

By following these tips, business owners can effectively leverage business credit cards that don’t report to personal to improve their business credit and access valuable financing options.

FAQ on Business Credit Cards That Don’t Report to Personal

Q: Are there any drawbacks to using a business credit card that doesn’t report to personal?

A: Yes, some potential drawbacks include higher fees, less protection against fraud, and limited rewards or benefits.

Q: Can I use a business credit card that doesn’t report to personal for personal expenses?

A: No, it is strongly discouraged to use a business credit card for personal expenses as this can damage business credit and potentially result in personal liability.

Q: How can I check my business credit score?

A: There are several business credit reporting agencies that provide business credit scores. Some of the most popular include Dun & Bradstreet, Equifax Business, and Experian Business.

Conclusion

Business credit cards that don’t report to personal offer a valuable tool for businesses to build a strong credit history and access financing without impacting their personal credit. By understanding how these cards work and following the expert advice provided, businesses can effectively manage and leverage business credit cards to achieve their financial goals. If you’re a business owner interested in exploring this option, consider reaching out to a financial advisor or lender to learn more about the available options.

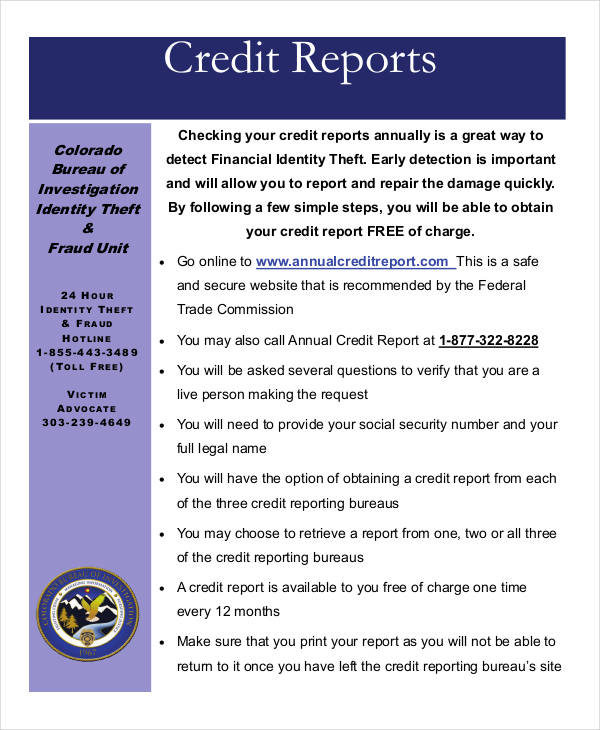

Image: www.examples.com

Thank you for visiting our website and taking the time to read Business Credit Cards That Don’T Report To Personal. We hope you find benefits from this article.

Hogki.com Trusted Information and Education News Media

Hogki.com Trusted Information and Education News Media