Explore the Charitable Remainder Trust Pros And Cons article containing information you might be looking for, hopefully beneficial for you.

Charitable Remainder Trusts: Pros and Cons to Consider

Charitable remainder trusts (CRTs) are irrevocable trusts that provide tax benefits to donors while supporting charitable causes. They have become increasingly popular as a way to reduce estate taxes and support long-term charitable goals. However, it’s crucial to understand both the advantages and disadvantages before establishing a CRT.

In this article, we’ll delve into the intricate world of CRTs, exploring their history, definitions, and the latest industry developments. We’ll also provide expert insights and advice to help you make an informed decision. Whether you’re a seasoned investor or a novice seeking to navigate the complexities of charitable giving, this comprehensive guide will empower you with the knowledge to evaluate the potential benefits and drawbacks of CRTs.

Understanding Charitable Remainder Trusts (CRTs)

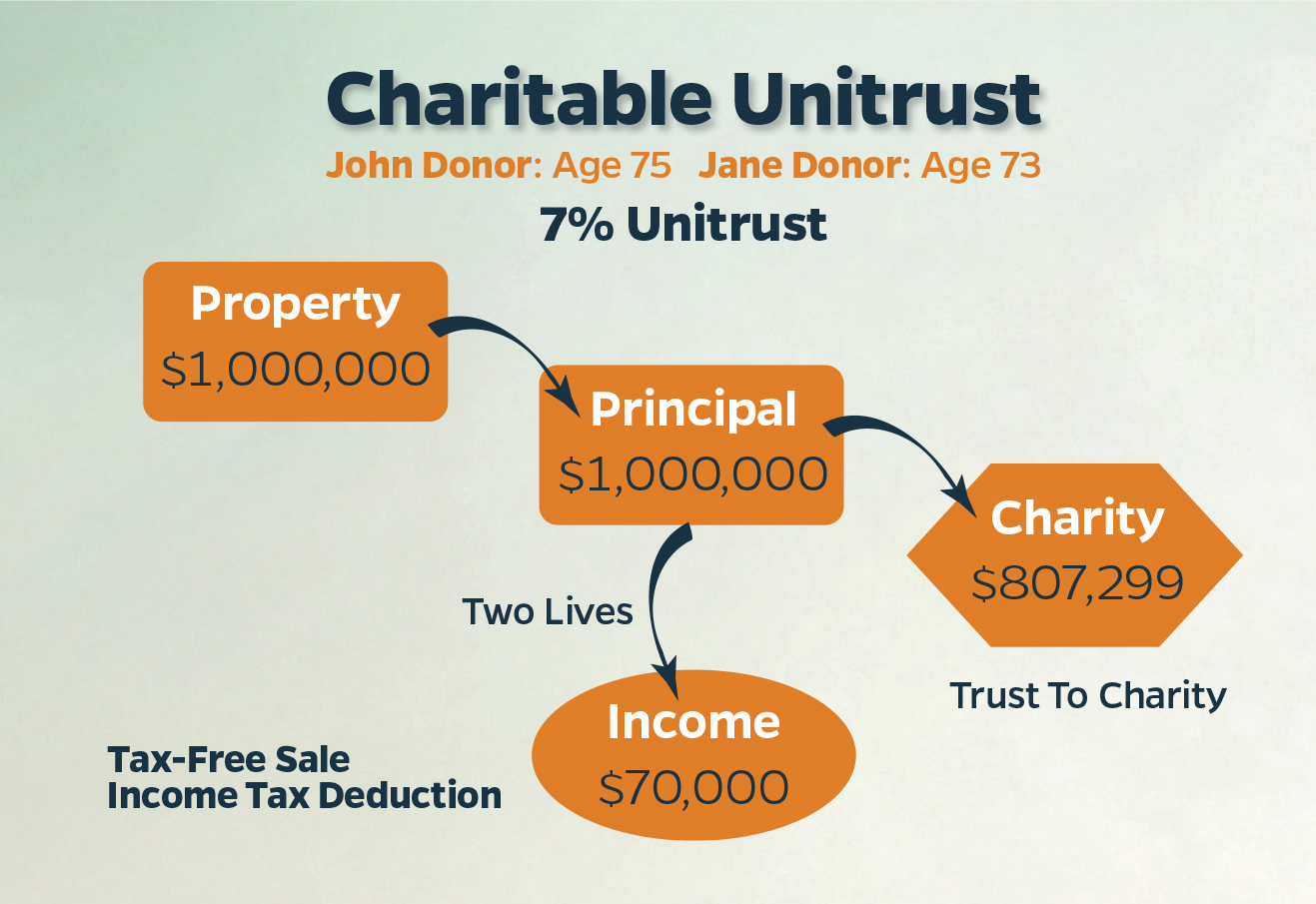

Charitable remainder trusts are legal entities created to provide an income stream to beneficiaries for a specified period, typically the lifetime of the donor or a certain number of years. Upon termination of the trust, the remaining assets are distributed to a designated charity, hence the term “remainder.” CRTs offer significant tax advantages, including income tax deductions, estate tax savings, and potential capital gains tax avoidance.

CRTs are categorized into two primary types: charitable remainder annuity trusts (CRATs) and charitable remainder unitrusts (CRUTs). CRATs pay a fixed annual income, while CRUTs pay a percentage of the trust’s value each year, providing greater flexibility to adjust for market fluctuations.

Key Advantages of Charitable Remainder Trusts

- Income Tax Deductions: Donors receive an immediate income tax deduction for the present value of the remainder interest transferred to the charity.

- Estate Tax Savings: The value of the assets placed in the CRT is removed from the donor’s estate, reducing potential estate taxes.

- Capital Gains Tax Avoidance: When appreciated assets are donated to a CRT, the capital gains tax is deferred until the trust sells the assets, potentially saving a substantial amount in taxes.

- Support for Charitable Causes: CRTs provide a means to support charitable organizations while retaining control over the assets during the donor’s lifetime.

Expert Tip: Consider establishing a CRT if you have highly appreciated assets, such as stocks or real estate, and wish to reduce your tax burden while supporting a charitable cause you care about.

Potential Disadvantages of Charitable Remainder Trusts

- Irrevocable Nature: CRTs are irrevocable, meaning the donor cannot access or change the terms of the trust once established.

- Limited Income: The amount of income generated by a CRT is fixed and cannot be adjusted to meet changing financial needs.

- Potential Loss of Control: The donor relinquishes control over the assets placed in the CRT, which are managed by a trustee.

- Complexities: Setting up and administering a CRT can be complex and involve legal and tax considerations, requiring professional guidance.

Expert Advice: Before establishing a CRT, carefully consider your financial situation, income needs, and long-term charitable goals. Consult with an estate planning attorney and financial advisor to ensure the CRT is aligned with your objectives.

Recent Trends and Developments in Charitable Remainder Trusts

The charitable remainder trust landscape is constantly evolving, with recent developments and trends influencing their application. One notable trend is the increasing use of CRUTs over CRATs due to their flexibility and ability to adapt to market conditions.

Additionally, the Tax Cuts and Jobs Act of 2017 introduced modifications to the estate tax exemption, which may impact the attractiveness of CRTs for some individuals. Staying abreast of these changes is crucial to optimize the benefits of charitable remainder trusts.

FAQs on Charitable Remainder Trusts

Q: What is the minimum amount required to establish a CRT?

A: There is no minimum amount, but a substantial contribution is typically recommended to ensure the trust meets its objectives.

Q: Can I make changes to a CRT after it is established?

A: CRTs are generally irrevocable, meaning the terms cannot be modified unless specific exceptions apply.

Q: How are the assets in a CRT managed?

A: A trustee is responsible for managing the trust’s assets and making investment decisions in accordance with the trust document.

Q: Is it possible to receive a higher income from a CRT?

A: While the income from a CRT is fixed, the percentage used to calculate the income can be increased within certain limits to provide a greater payout.

Q: What happens if the CRT terminates early?

A: In case of early termination, the remaining assets in the trust may be distributed to the donor or their heirs, rather than the intended charity.

Conclusion

Charitable remainder trusts offer unique opportunities for individuals to reduce their tax burden and make a lasting impact on charitable causes. However, it is essential to carefully consider the pros and cons before making a decision. By understanding the key advantages, potential disadvantages, recent trends, and expert insights, you can make an informed choice that aligns with your financial and charitable goals.

If you are interested in learning more about charitable remainder trusts or exploring if they are the right fit for you, we encourage you to consult with an estate planning attorney and financial advisor. These professionals can provide personalized guidance and help you navigate the complexities of CRTs to maximize their benefits and minimize their potential drawbacks.

Image: www.thrivent.com

Charitable Remainder Trust Pros And Cons has been read by you on our site. Thank you for your visit, and we hope this article is beneficial for you.

Hogki.com Trusted Information and Education News Media

Hogki.com Trusted Information and Education News Media