Want to know more about Does An Executor Have To Provide Receipts? Read this article to get the information you need.

Does an Executor Have to Provide Receipts?

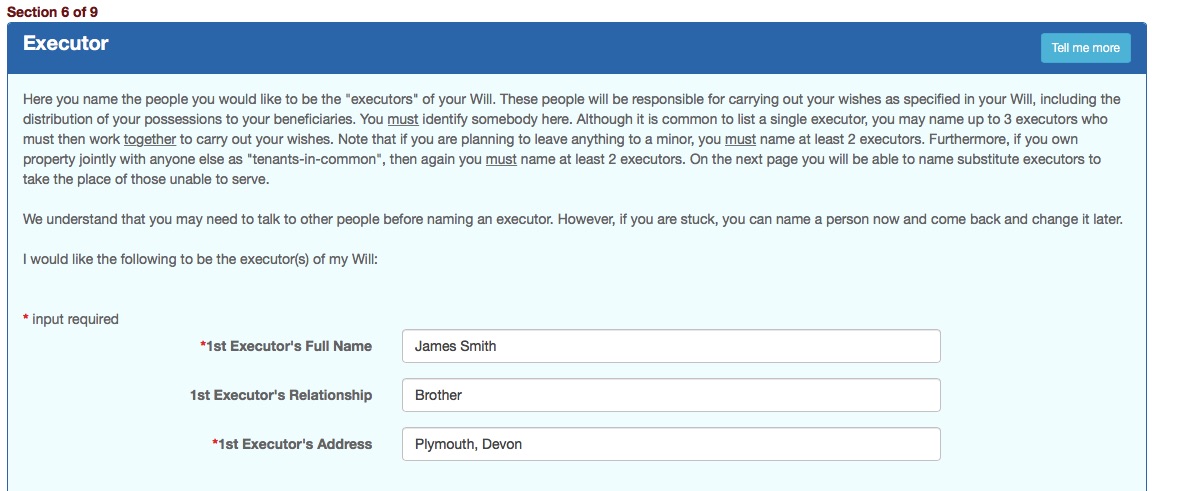

When a loved one passes away, it is common for their will to name an executor to manage their estate. The executor is responsible for carrying out the deceased person’s wishes, such as distributing their assets to beneficiaries. In some cases, the executor may be asked to provide receipts for expenses incurred during the probate process. However, there is no universal rule that requires executors to provide receipts.

The need for receipts will vary depending on the circumstances of the estate. If the estate is small and straightforward, the beneficiaries may not need to see receipts for every expense. However, if the estate is large or complex, the beneficiaries may want to see receipts to ensure that the executor is using the estate’s funds appropriately.

State Laws and Executor Responsibilities

In some states, there are specific laws that govern whether or not an executor must provide receipts. For example, California law requires executors to provide receipts for all expenses over $1,000. Other states, such as New York, do not have any specific laws that require executors to provide receipts.

Even if there is no specific law that requires executors to provide receipts, they may still be required to do so if the beneficiaries request them. Beneficiaries have a right to know how the estate’s funds are being used, and receipts can provide this information.

Best Practices for Executors

As a best practice, it is advisable for executors to provide receipts for all expenses incurred during the probate process. This will help to build trust with the beneficiaries and ensure that they are comfortable with the way the estate is being handled.

Receipts can also be helpful for the executor in the event of an audit. If the executor is audited by the IRS, they will need to be able to provide documentation for all of the expenses that they claimed. Receipts will help to prove that the expenses were legitimate and that the executor is not misusing the estate’s funds.

Tips and Expert Advice

Here are some tips and expert advice for executors who are considering providing receipts:

- Keep a detailed record of all expenses. This will make it easier to provide receipts to the beneficiaries or the IRS if necessary.

- Use a consistent format for receipts. This will make it easier for the beneficiaries to read and understand.

- Provide receipts in a timely manner. The beneficiaries will be more likely to trust the executor if they receive receipts promptly.

Conclusion

Whether or not an executor must provide receipts is a question that can be answered by looking at the specific laws of the state where the estate is being probated. However, even if there is no specific law that requires executors to provide receipts, it is advisable to do so as a best practice. Receipts will help to build trust with the beneficiaries and ensure that they are comfortable with the way the estate is being handled.

Are you interested in learning more about the role of an executor? Click here to read our article on the topic.

FAQs

Q: What are the duties of an executor?

An executor is responsible for carrying out the deceased person’s wishes, such as distributing their assets to beneficiaries.

Q: Do I have to provide receipts for all expenses incurred during the probate process?

The need for receipts will vary depending on the circumstances of the estate. It is always advisable to provide receipts for any expenses over $1,000.

Q: What should I do if a beneficiary requests a receipt for an expense?

You should provide the beneficiary with the receipt as soon as possible. It is important to be transparent with the beneficiaries and to answer their questions promptly.

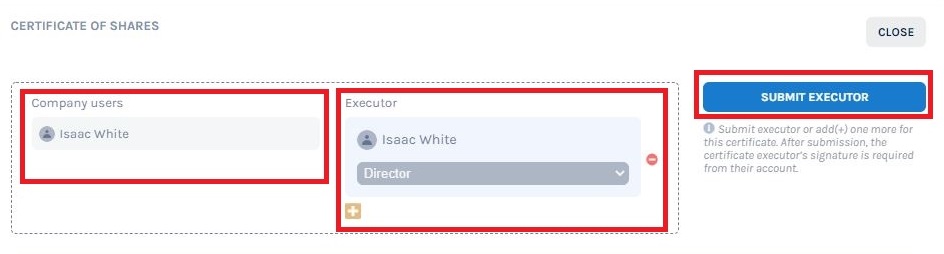

Image: eqvista.com

We express our gratitude for your visit to our site and for taking the time to read Does An Executor Have To Provide Receipts. We hope this article is beneficial for you.

Hogki.com Trusted Information and Education News Media

Hogki.com Trusted Information and Education News Media