Discover various information about How Many Payments Before Your Car Is Repossessed here, hopefully fulfilling your information needs.

How Many Payments Before Your Car is Repossessed?

A car is often one of the most expensive purchases in your life, so missing payments can be a big deal. Most people are aware that if they miss too many payments, the lender can repossess the car. But how many payments can you miss before this happens? The answer to this question depends on a number of factors, including the terms of your loan agreement, the state you live in, and the lender’s policies. Still, there are some general rules that apply in most cases.

In most cases, the lender will begin the repossession process after you have missed two or three payments. However, some lenders may start the process even sooner, so it’s important to check your loan agreement to find out what the specific terms are. If you miss a payment, the lender will typically send you a notice that you are in default. This notice will give you a certain amount of time to catch up on your payments. If you do not catch up within the time frame specified in the notice, the lender may start the repossession process.

Warning Signs of Impending Repossession

In addition to missing payments, there are a few other signs that your car may be at risk of being repossessed. These include:

- Receiving a call from the lender threatening repossession

- Noticing someone following you or your car

- Finding a tracking device on your car

- Having your car towed without your consent

If you notice any of these signs, it’s important to act quickly. Contact the lender immediately and try to make arrangements to catch up on your payments. You may also want to consider hiring an attorney who specializes in repossession law.

The Repossession Process

If the lender does decide to repossess your car, they will typically follow a specific process. This process may vary depending on the state you live in, but it generally includes the following steps:

- The lender will send you a notice of default, giving you a certain amount of time to catch up on your payments.

- If you do not catch up on your payments within the time frame specified in the notice, the lender may file a lawsuit against you.

- If the lender wins the lawsuit, they will be awarded a judgment against you. This judgment will give the lender the right to repossess your car.

- Once the lender has a judgment against you, they can send a repossession agent to take your car.

The repossession process can be very stressful, but it’s important to remember that you have rights. If your car is repossessed, you can file a lawsuit against the lender to get it back. You may also be able to get compensation for any damages that you have suffered.

Tips for Avoiding Repossession

There are a number of things you can do to avoid having your car repossessed, including:

- Making your payments on time, every time.

- Contacting the lender immediately if you are having trouble making your payments.

- Keeping your car insurance up to date.

- Avoiding any major repairs or modifications to your car without the lender’s consent.

If you follow these tips, you can reduce the risk of having your car repossessed and protect your credit score.

FAQs About Car Repossession

Q: How long do I have to catch up on my payments after I receive a notice of default?

A: The amount of time you have to catch up on your payments will vary depending on the terms of your loan agreement and the state you live in. However, it is typically around 30 days.

Q: What happens if I can’t catch up on my payments?

A: If you cannot catch up on your payments, the lender may file a lawsuit against you. If the lender wins the lawsuit, they will be awarded a judgment against you. This judgment will give the lender the right to repossess your car.

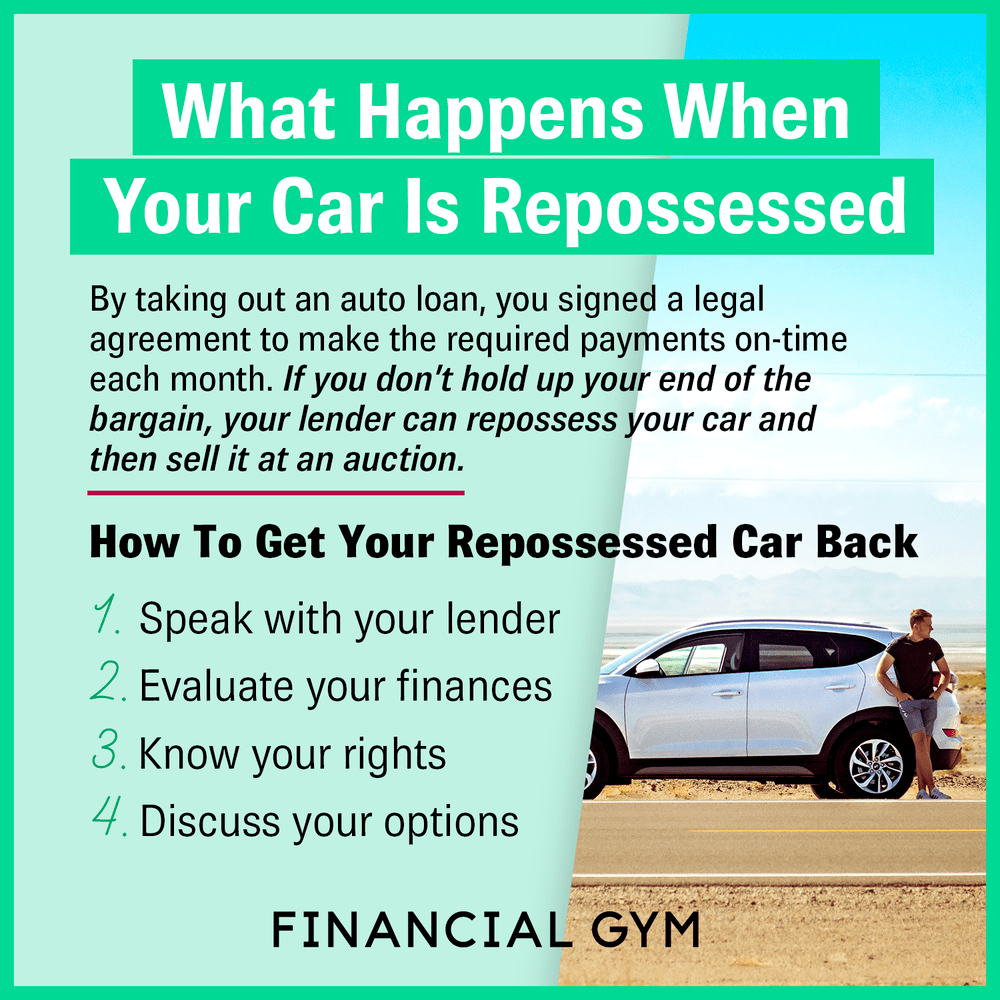

Q: What can I do if my car is repossessed?

A: If your car is repossessed, you can file a lawsuit against the lender to get it back. You may also be able to get compensation for any damages that you have suffered.

Conclusion

If you are behind on your car payments, it’s important to act quickly. Contact the lender immediately and try to make arrangements to catch up on your payments. You may also want to consider hiring an attorney who specializes in repossession law. By taking these steps, you can increase your chances of keeping your car.

Are you interested in learning more about car repossession?

Image: financialgym.com

How Many Payments Before Your Car Is Repossessed has been read by you on our site. We express our gratitude for your visit, and we hope this article is beneficial for you.

Hogki.com Trusted Information and Education News Media

Hogki.com Trusted Information and Education News Media