This article discusses How To Count Car Loan Interest, hopefully providing additional knowledge for you.

Unveiling the Enigma of Car Loan Interest: A Comprehensive Guide to Empowerment

In the realm of personal finance, car loans often serve as essential financial tools. However, navigating the intricate labyrinth of interest calculations can leave even the most astute borrowers perplexed. Enter this comprehensive guide, designed to demystify car loan interest and empower you with financial clarity.

Before embarking on this journey, allow me to share a personal anecdote. As a newlywed couple, my wife and I embarked on the exciting adventure of purchasing our first car. Armed with limited financial knowledge, we found ourselves grappling with the complexities of car loan interest rates. Determined to make an informed decision, we devoted ourselves to understanding the intricacies of this financial enigma.

Deciphering Car Loan Interest: A Layperson’s Guide

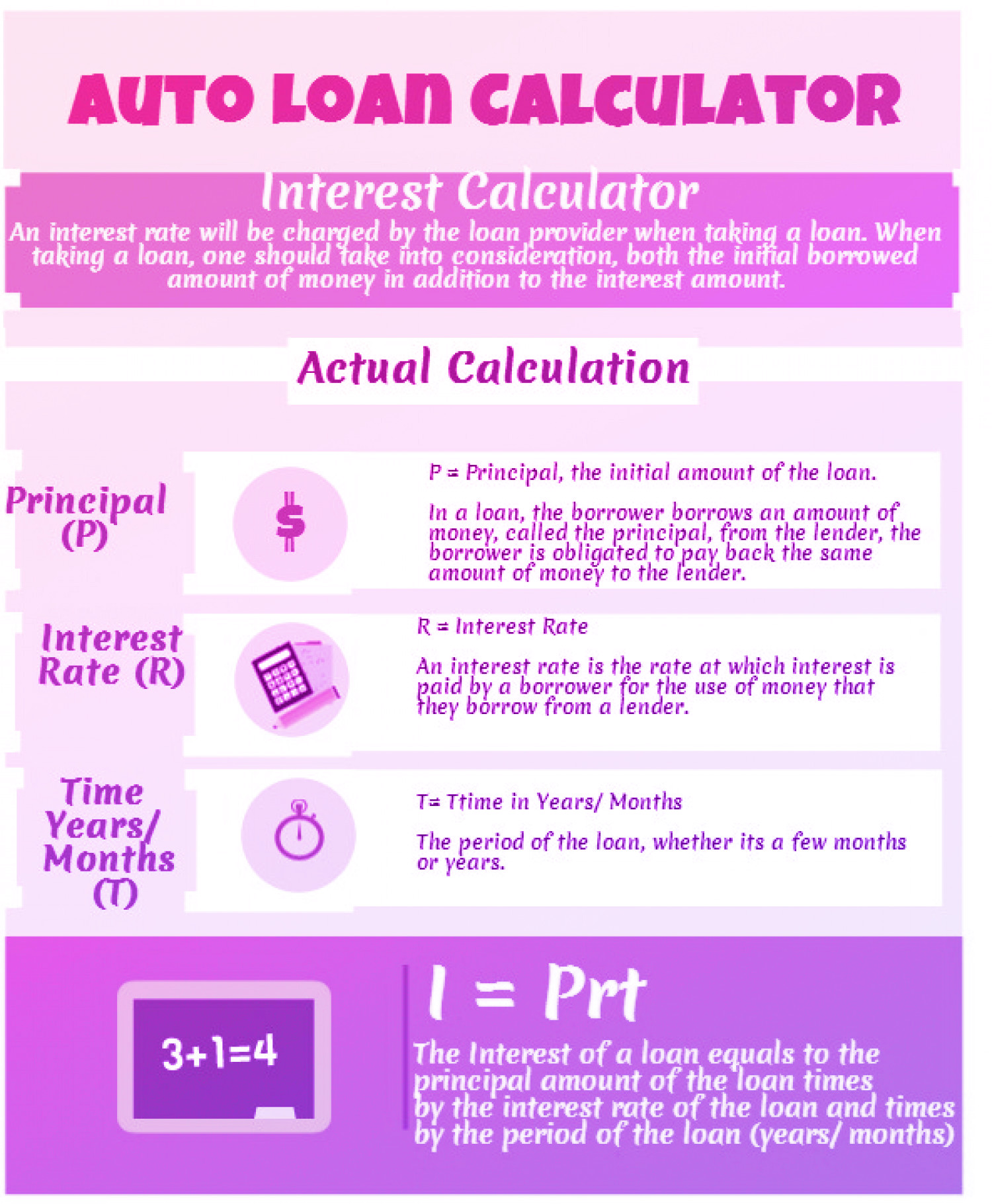

At its core, car loan interest represents the fee levied by lenders for borrowing money. This fee is typically expressed as an annual percentage rate (APR), which encompasses not only the base interest rate but also additional charges like origination fees and points.

To calculate the total interest paid over the loan term, multiply the loan amount by the APR and the number of years of the loan. For instance, if you borrow $20,000 for a five-year loan with an APR of 5%, the total interest paid would amount to $2,500.

The Art of Amortization: Unraveling the Loan Repayment Schedule

The process of amortization gradually reduces the loan balance and interest payments over the loan term. With each monthly payment, a portion is allocated towards interest, while the remainder goes towards reducing the principal. As the loan balance decreases, so too do the interest payments.

Amortization schedules, typically provided by lenders, offer a detailed breakdown of each payment, illustrating how the loan balance and interest payments evolve over time. This invaluable tool allows borrowers to track their progress and project future payments.

Trends in Car Loan Interest: A Dynamic Market

The landscape of car loan interest rates is constantly evolving, influenced by factors such as economic conditions, Federal Reserve policy, and competition among lenders. In recent years, the advent of online lending platforms has intensified competition, leading to lower interest rates for borrowers with good credit.

Staying abreast of these trends is crucial for securing the most favorable loan terms. Monitoring interest rate fluctuations and comparing offers from multiple lenders empowers borrowers with the knowledge to make informed decisions that minimize their financial burden.

Tips for Savvy Car Loan Borrowers: Unlocking Financial Empowerment

Armed with a comprehensive understanding of car loan interest, you are well-equipped to navigate the financial landscape with confidence. Here are some expert tips to guide you on your journey:

- Establish a Solid Credit Score: Lenders perceive borrowers with higher credit scores as less risky, rewarding them with lower interest rates. Building a strong credit history through responsible borrowing and timely payments can significantly reduce your borrowing costs.

- Shop Around for the Best Rates: Don’t settle for the first loan offer that comes your way. Compare interest rates from multiple lenders to ensure you secure the most competitive terms. Online loan marketplaces and financial aggregators offer convenient platforms for comparing rates.

- Negotiate with Confidence: While lenders typically set their interest rates, negotiating is not always out of the question. Be prepared to present your financial strengths, such as a high credit score or substantial down payment, to negotiate a more favorable rate.

- Consider Refinancing Options: If interest rates have dropped significantly since you took out your car loan, refinancing may be a viable option to reduce your monthly payments or shorten the loan term.

- Choose a Shorter Loan Term: While shorter loan terms generally result in higher monthly payments, they can save you a considerable amount of interest over the life of the loan.

Adhering to these tips empowers you to make informed financial decisions that minimize the cost of borrowing and maximize your financial well-being.

Frequently Asked Questions: Empowering Car Loan Borrowers with Clarity

- Q: What factors influence car loan interest rates?

A: Credit score, loan term, loan amount, and the lender’s risk assessment all play a role in determining interest rates. - Q: Can I get a car loan with a bad credit score?

A: Yes, but expect to pay a higher interest rate. Co-signers with good credit can improve your chances of loan approval and lower interest rates. - Q: What is the difference between APR and interest rate?

A: Interest rate is the base cost of borrowing, while APR includes additional charges like origination fees and points. - Q: Can I prepay my car loan without penalty?

A: Most lenders allow prepayment without penalty, but it’s always advisable to check the loan agreement to confirm. - Q: What is a good credit score for a car loan?

A: Generally, a credit score of 700 or above is considered good and will qualify you for the most favorable interest rates.

Conclusion: Empowering Financial Confidence through Car Loan Literacy

Unveiling the enigma of car loan interest empowers you to make informed financial decisions that can save you thousands of dollars over the life of your loan. By understanding the concepts outlined in this guide, you gain the confidence to navigate the lending landscape with ease, ensuring that your car loan serves as a tool for financial empowerment rather than a source of financial burden.

If you found this article informative, please share it with others who may benefit from this knowledge. By collectively empowering ourselves with financial literacy, we can unlock a world of financial freedom and opportunity.

Image: www.loanry.com

Thank you for visiting our website and taking the time to read How To Count Car Loan Interest. We hope you find benefits from this article.

Hogki.com Trusted Information and Education News Media

Hogki.com Trusted Information and Education News Media