Discover various information about Interest Rate To Money Factor Calculator here, hopefully fulfilling your information needs.

**Interest Rate to Money Factor Calculator**

In the captivating world of real estate finance, one crucial calculation that holds immense significance is the conversion from interest rate to money factor. As a savvy investor navigating this realm, it is imperative to grasp this concept thoroughly. Picture this: you stumble upon an attractive investment property with an interest rate of 5%. Intrigued, you delve deeper, longing to determine the equivalent money factor to assess its affordability. Enter the Interest Rate to Money Factor Calculator – your trusty companion in this financial maze.

The money factor, also known as the periodic rate, represents a percentage that is applied to the loan balance to calculate your monthly mortgage payment. By understanding how interest rates translate into money factors, you gain the power to make informed decisions, comparing loan options with ease and confidence. So, let’s embark on a comprehensive journey to unravel the intricacies of this essential calculation.

**Demystifying the Money Factor**

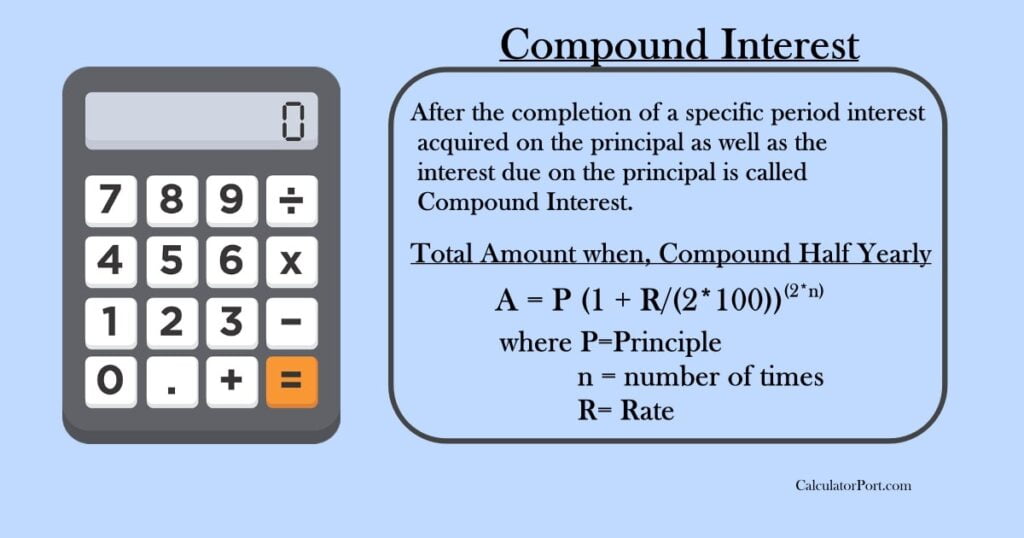

The money factor, often expressed as a decimal, is the foundation upon which your monthly mortgage payment is built. It encapsulates the interest rate, loan term, and compounding frequency, embodying the essence of your loan’s financial characteristics. To derive the money factor, the following formula serves as your guide: Money Factor = (Interest Rate / 12) x (1 + (Interest Rate / 12))n, where n represents the number of months in your loan term.

Consider the earlier example: with an interest rate of 5%, the money factor translates to (5% / 12) x (1 + (5% / 12))360, resulting in a value of 0.00417. This seemingly intricate calculation simplifies the process of determining your monthly payment. Simply multiply the money factor by the loan balance to uncover the exact amount you will owe each month throughout your mortgage journey.

**Harnessing the Interest Rate to Money Factor Calculator**

In the digital age, we are blessed with a plethora of tools that streamline our financial endeavors. The Interest Rate to Money Factor Calculator stands as a shining example of this technological marvel. This user-friendly tool invites you to input your desired interest rate and loan term, instantly churning out the corresponding money factor. With its intuitive interface and lightning-fast computations, you can effortlessly compare multiple loan scenarios, identifying the option that best aligns with your financial goals.

Whether you are a seasoned real estate investor or a first-time homebuyer, the Interest Rate to Money Factor Calculator empowers you with the knowledge and confidence to navigate the mortgage market with aplomb. Embrace its capabilities to assess loan affordability, optimize your financial strategy, and make informed decisions that set you on the path to real estate success.

**Expert Advice for Navigating the Money Factor Maze**

As you delve into the world of mortgages, it is wise to seek guidance from those who have mastered its intricacies. Seasoned real estate professionals and financial advisors offer invaluable insights, helping you make the most of your investment journey. Here are some expert tips to guide your path:

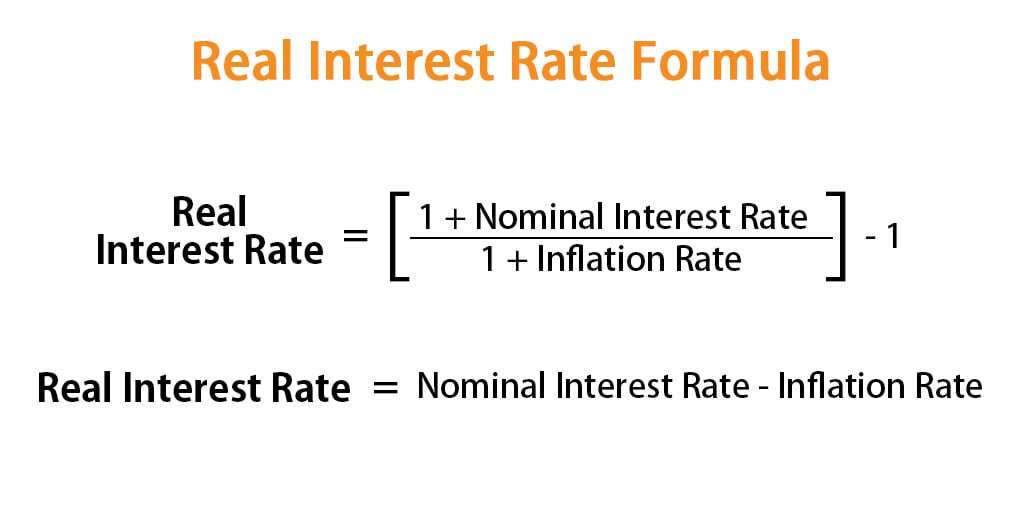

– **Shop around for competitive interest rates:** Don’t settle for the first loan you come across; dedicate time to compare interest rates from multiple lenders. A lower interest rate directly translates into a lower money factor, saving you money over the life of your loan.

– **Choose an appropriate loan term:** The loan term significantly impacts the money factor. Longer loan terms generally result in lower monthly payments but higher overall interest paid. Conversely, shorter loan terms lead to higher monthly payments but lower total interest costs.

– **Consider your financial goals:** Before committing to a loan, carefully assess your financial objectives. Determine if the monthly payment fits comfortably within your budget and aligns with your long-term financial aspirations.

**Frequently Asked Questions on Interest Rates and Money Factors**

To further enhance your understanding, here are some commonly asked questions and their answers:

**Q: How does compounding frequency affect the money factor?**

A: Compounding frequency determines how often interest is added to the loan balance. More frequent compounding leads to a slightly higher money factor compared to less frequent compounding.

**Q: Can I use the money factor to compare loans with different interest rates?**

A: Absolutely! The money factor provides a standardized basis for comparing loans with varying interest rates and loan terms, enabling you to make apples-to-apples comparisons.

**Q: Is a higher money factor always a bad thing?**

A: Not necessarily. A higher money factor can sometimes indicate a shorter loan term, which can save you money on interest in the long run.

**Conclusion**

Comprehension of the intricate relationship between interest rates and money factors empowers you to make informed decisions in the realm of real estate finance. By utilizing the Interest Rate to Money Factor Calculator, seeking expert advice, and familiarizing yourself with common FAQs, you equip yourself with the knowledge and tools necessary to secure the most favorable mortgage terms. Whether you are a seasoned investor or embarking on your first real estate endeavor, a thorough understanding of this crucial concept paves the way for successful financial navigation and the realization of your homeownership dreams.

So, dear reader, are you ready to embrace the power of financial literacy and unlock the potential of your real estate investments? Let us know if you have any further inquiries or seek additional guidance on this intriguing topic.

Image: haipernews.com

Interest Rate To Money Factor Calculator has been read by you on our site. Thank you for your visit, and we hope this article is beneficial.

Hogki.com Trusted Information and Education News Media

Hogki.com Trusted Information and Education News Media