Explore the S Age 40 Is Looking To Buy A Life Insurance article containing information you might be looking for, hopefully beneficial for you.

Is It Too Late to Buy Life Insurance at Age 40?

My father passed away at 45, leaving behind a wife and two young children. As the breadwinner, his sudden passing left a financial void in our family. Though we had a small life insurance policy that helped with funeral expenses, it barely scratched the surface of our financial needs.

This event made me realize the importance of life insurance, especially for those with dependents. It got me thinking – is it too late to buy life insurance at 40? In this article, we’ll delve into the world of life insurance for individuals in their 40s, navigating the key considerations and providing valuable tips.

The Significance of Life Insurance at Age 40

Purchasing life insurance in your 40s is a wise financial decision for several reasons. At this stage in life, you may have accumulated significant financial responsibilities such as a mortgage, car payments, and child-related expenses. Life insurance can provide peace of mind knowing that your loved ones will be financially secure in the event of your unexpected passing.

Furthermore, life insurance premiums are generally higher as you age. By securing a policy in your 40s, you can lock in lower rates and potentially save thousands of dollars over the long run. As you approach retirement, having a life insurance policy can also supplement your retirement savings and provide additional financial protection for your spouse or beneficiaries.

Types of Life Insurance for Individuals Over 40

There are two main types of life insurance available: term life insurance and permanent life insurance.

Term life insurance provides coverage for a specified period, such as 10, 20, or 30 years. It is typically more affordable than permanent life insurance, making it a good option for individuals looking for short-term coverage. However, once the term expires, the policy ends, and you will need to renew it or purchase a new one.

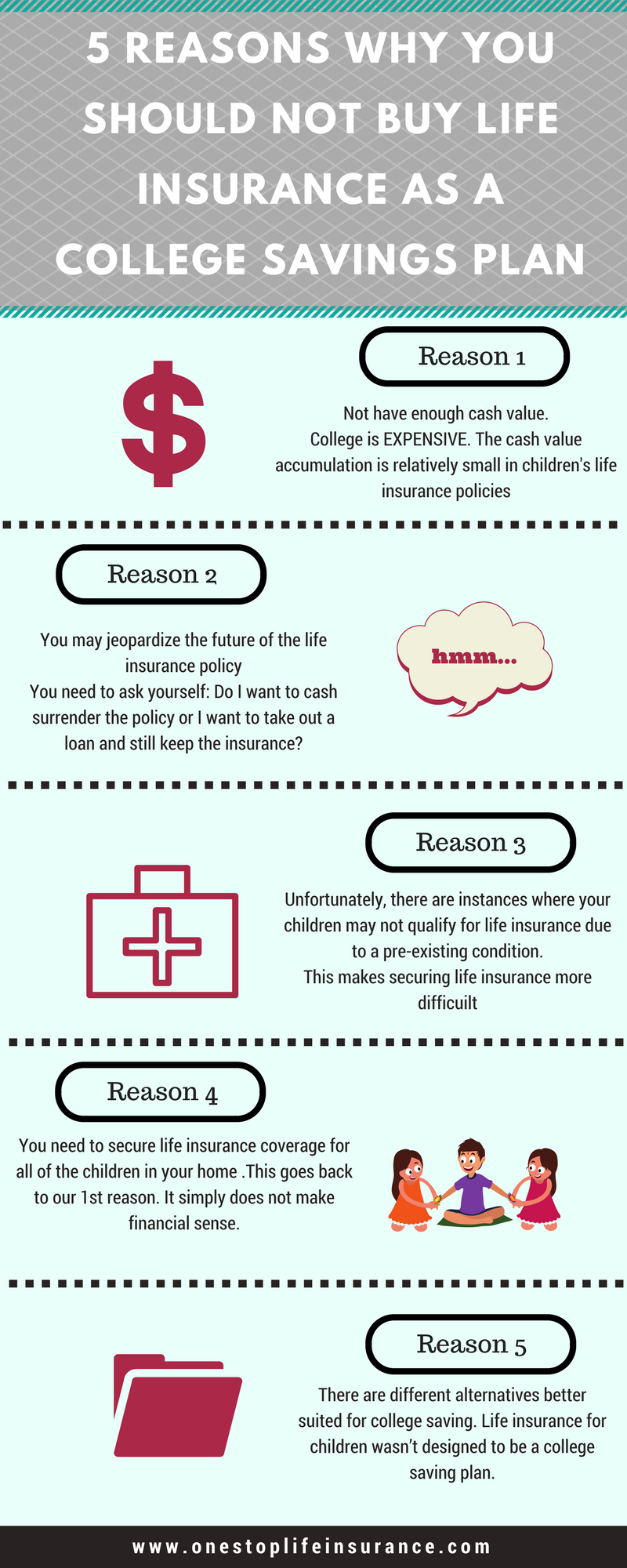

Permanent life insurance, on the other hand, provides lifelong coverage and includes a cash value component that grows over time. This cash value can be borrowed against or withdrawn for various purposes, such as supplementing retirement income or funding a child’s education.

Factors to Consider When Purchasing Life Insurance in Your 40s

Before purchasing a life insurance policy, it is crucial to consider the following factors:

- Your income and expenses – Determine how much life insurance coverage you need to replace your income and cover your family’s expenses in the event of your death.

- Your health and lifestyle – Your health and lifestyle can impact your life insurance premiums. Be prepared to provide information about your medical history, smoking habits, and any hazardous activities you participate in.

- Your financial goals – Consider your long-term financial goals and how life insurance can help you achieve them. If you plan to retire early or leave a legacy for your family, permanent life insurance may be a suitable option.

- Your budget – Life insurance premiums can vary depending on the type of policy, the amount of coverage, and your age and health. Determine how much you can afford to pay for premiums on a monthly or annual basis.

Tips for Getting the Best Life Insurance Coverage

Follow these tips to ensure you get the best life insurance coverage for your needs:

- Compare quotes from multiple insurance providers – Don’t settle for the first quote you get. Shop around and compare premiums and coverage options from different insurers to find the best deal.

- Consider working with an insurance agent – An experienced insurance agent can provide personalized advice and help you navigate the complexities of life insurance policies.

- Be honest and accurate when applying for coverage – Withhold or misrepresenting information on your application can lead to denied claims or higher premiums.

- Review your policy regularly – As your life circumstances change, such as getting married, having children, or changing jobs, review your policy to ensure it still meets your needs.

Frequently Asked Questions (FAQs)

Q: Is it too late to buy life insurance at age 40?

A: No, it is not too late to buy life insurance at age 40. While premiums may be slightly higher than if you had purchased a policy earlier, it is still a valuable investment to protect your loved ones.

Q: What type of life insurance is best for individuals over 40?

A: The best type of life insurance depends on your individual needs and financial goals. Term life insurance is more affordable, while permanent life insurance provides lifelong coverage and a cash value component.

Q: How much life insurance do I need?

A: The amount of life insurance coverage you need depends on factors such as your income, expenses, and financial goals. A general rule of thumb is to purchase coverage that is 10-15 times your annual income.

Conclusion

Purchasing life insurance in your 40s is a responsible financial decision that can provide peace of mind and financial security for your loved ones. By considering the factors outlined in this article and following the tips provided, you can find the best life insurance coverage to meet your needs and protect your family’s future.

Is age 40 too late to buy life insurance? Absolutely not. It’s the perfect time to secure your family’s financial well-being and give yourself the priceless gift of peace of mind.

Image: www.bartleby.com

S Age 40 Is Looking To Buy A Life Insurance has been read by you on our site. We express our gratitude for your visit. We hope you benefit from S Age 40 Is Looking To Buy A Life Insurance.

Hogki.com Trusted Information and Education News Media

Hogki.com Trusted Information and Education News Media